1. Glass fiber: rapid growth in production capacity

In 2021, the total production capacity of glass fiber roving in China (only referring to the mainland) reached 6.24 million tons, with a year-on-year increase of 15.2%. Considering that the production capacity growth rate of the industry affected by the epidemic in 2020 was only 2.6%, the average growth rate in two years was 8.8%, which basically remained within a reasonable growth range. Affected by the "dual carbon" development strategy, domestic demand for new energy vehicles, building energy efficiency, electronic and electrical appliances and wind power and new energy sectors began to exert momentum. At the same time, overseas markets were affected by COVID-19, and the imbalance between supply and demand was serious. Various types of fiberglass roving, such as electronic yarn and industrial spinning, have been in short supply and prices have increased in turns.

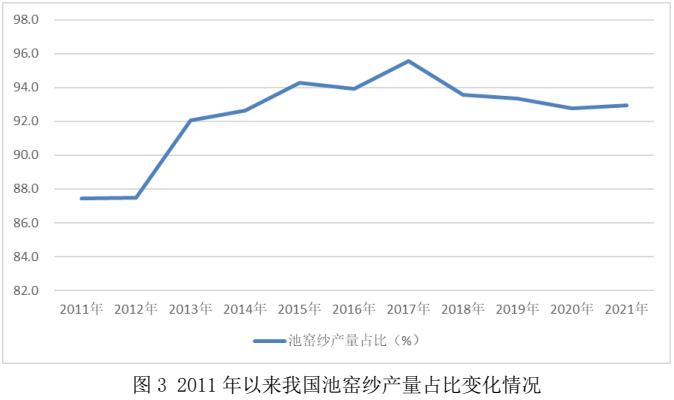

In 2021, the total production capacity of domestic tank kiln roving reached 5.8 million tons, with a year-on-year increase of 15.5%. Affected by the continuous rise in the price of various varieties of glass fiber roving since 2020, the domestic glass fiber production capacity is strongly willing to expand. However, under the influence of the continuous implementation of the "double control" policy of strict energy consumption, some new or cold repair and expansion projects of tank kilns are forced to postpone production. Nevertheless, 15 new and cold repair and expansion tanks and kilns will be completed and put into operation in 2021, with a new capacity of 902000 tons. By the end of 2021, the production capacity of domestic tank kilns has exceeded 6.1 million tons.

In 2021, the total production capacity of domestic crucible roving was about 439000 tons, with a year-on-year increase of 11.8%. Affected by the overall rise in the price of glass fiber roving, the production capacity of domestic crucible roving increased significantly. In recent years, crucible wire drawing enterprises have faced increasingly prominent problems, such as the continuous rise of energy raw materials and labor costs, the frequent interference of production by environmental protection and energy control policies, and the difficulty of products to meet the high-efficiency processing requirements of later products. In addition, the product quality of corresponding market segments is uneven, and the homogenization competition is serious, so there are still many difficulties in future development, It is only suitable for supplementary capacity supply, focusing on meeting the needs of the downstream small batch, multi variety and differentiated application market.

In 2021, the production capacity of glass balls for wire drawing of various crucibles in China was 992000 tons, with a year-on-year increase of 3.2%, which was significantly slower than that of last year. Under the background of "double carbon" development strategy, glass ball kiln enterprises are facing more and more shutdown pressure in terms of energy supply and raw material cost.

2. Glass fiber textile products: the scale of each market segment continues to grow

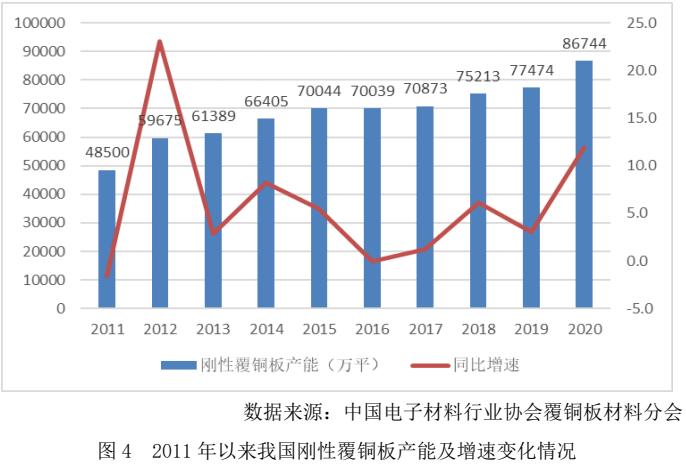

Electronic felt products: according to the statistics of China Glass Fiber Industry Association, the total production capacity of various electronic cloth / felt products in China in 2021 was about 806000 tons, a year-on-year increase of 12.9%. In recent years, in order to cooperate with the implementation of the national intelligent manufacturing development strategy, the capacity expansion of the electronic material industry has accelerated significantly.

According to the statistics of copper clad laminate branch of China Electronic Materials Industry Association, the domestic rigid copper clad laminate production capacity reached 867.44 million square meters in 2020, with a year-on-year increase of 12.0%, and the production capacity growth was significantly accelerated. In addition, in 2021, the production capacity of glass fiber cloth based copper clad laminate project will reach 53.5 million square meters / year, 202.66 million square meters / year and 94.44 million square meters / year respectively. There is an upsurge of large-scale investment and construction projects "unprecedented in many years" in the copper clad laminate industry, which is bound to drive the rapid growth of the demand for electronic glass fiber felt products.

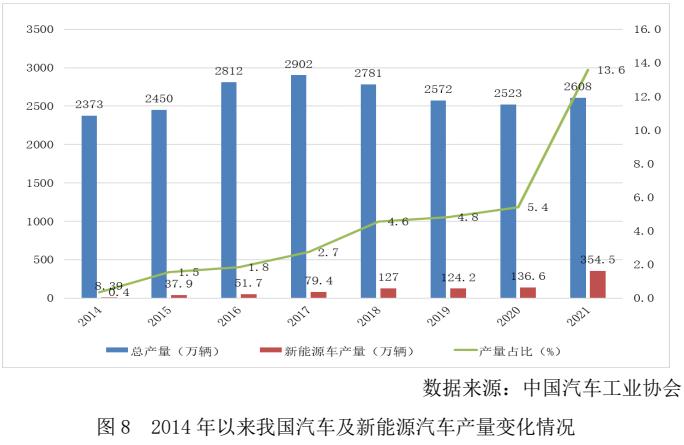

Industrial felt products: in 2021, the total production capacity of various industrial felt products in China was about 722000 tons, with a year-on-year increase of 10.6%. In 2021, the total investment in China's real estate development reached 147602 billion yuan, with a year-on-year increase of 4.4%. Under the guidance of the "double carbon" development strategy, the construction industry actively transformed into a low-carbon green development path, driving the continuous growth of the market for various types of glass fiber felt products in the fields of building reinforcement, energy conservation and thermal insulation, decoration, decoration, waterproof coiled materials and so on. In addition, the production capacity of new energy vehicles increased by 160%, the production capacity of air conditioners increased by 9.4% year-on-year, and the production capacity of washing machines increased by 9.5% year-on-year. The market of all kinds of glass fiber felt products for automotive thermal insulation and decoration, glass fiber felt products for electrical insulation, and glass fiber felt products for environmental protection filtration, road civil engineering and other fields maintained stable growth.

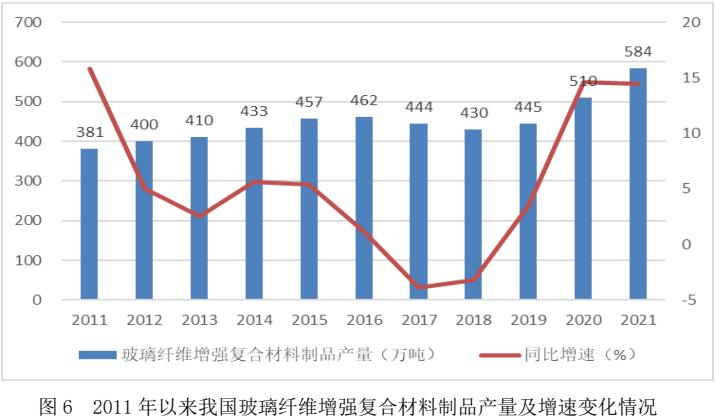

3. Glass fiber reinforced composite products: thermoplastic crystallization is growing rapidly

In 2021, the total production capacity of glass fiber reinforced composite products in China was about 5.84 million tons, with a year-on-year increase of 14.5%.

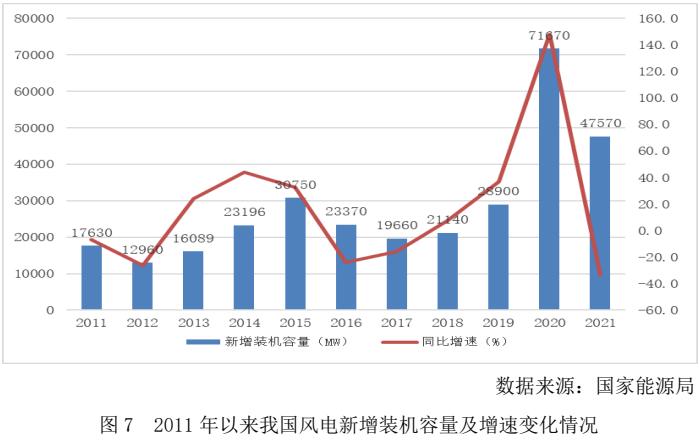

In terms of glass fiber reinforced thermosetting composite products, the total production capacity was about 3.1 million tons, a year-on-year increase of 3.0%. Among them, the wind power market experienced a phased correction in the middle of the year, and the annual production capacity decreased. However, benefiting from the "double carbon" development strategy, it has re entered the state of rapid development since the second half of the year. In addition, the automobile market has recovered significantly. Driven by the favorable carbon emission reduction policies, the construction and pipeline markets have gradually turned to standardized competition, and the related molding, pultrusion and continuous plate products have increased steadily.

In terms of glass fiber reinforced thermoplastic composite products, the total production capacity scale was about 2.74 million tons, with a year-on-year increase of about 31.1%. In 2021, China's automobile production reached 26.08 million, with a year-on-year increase of 3.4%. After three years, China's automobile production again achieved positive growth. Among them, the production capacity of new energy vehicles reached 3.545 million, with a year-on-year increase of 160%, driving the rapid growth of various thermoplastic composite products for automobiles. In addition, in recent years, air conditioners, washing machines, color televisions, refrigerators and other household electrical appliances have also maintained a stable growth trend. Gree, Haier, Midea and other large household electrical appliance manufacturers have arranged thermoplastic composite product production lines, driving the continuous optimization of market supply and demand pattern and rapid growth of production capacity.

Shanghai Orisen New Material Technology Co., Ltd

M: +86 18683776368(also WhatsApp)

T:+86 08383990499

Email: grahamjin@jhcomposites.com

Address: NO.398 New Green Road Xinbang Town Songjiang District, Shanghai

Post time: Mar-16-2022